To Deal or Not To Deal in Private Equity?

While perhaps not quite the same existential crisis that Hamlet faced, Private Equity dealmakers are faced with a similarly pivotal question when assessing their aging portfolio: to deal, or not to deal?

The Changing Landscape of Private Equity

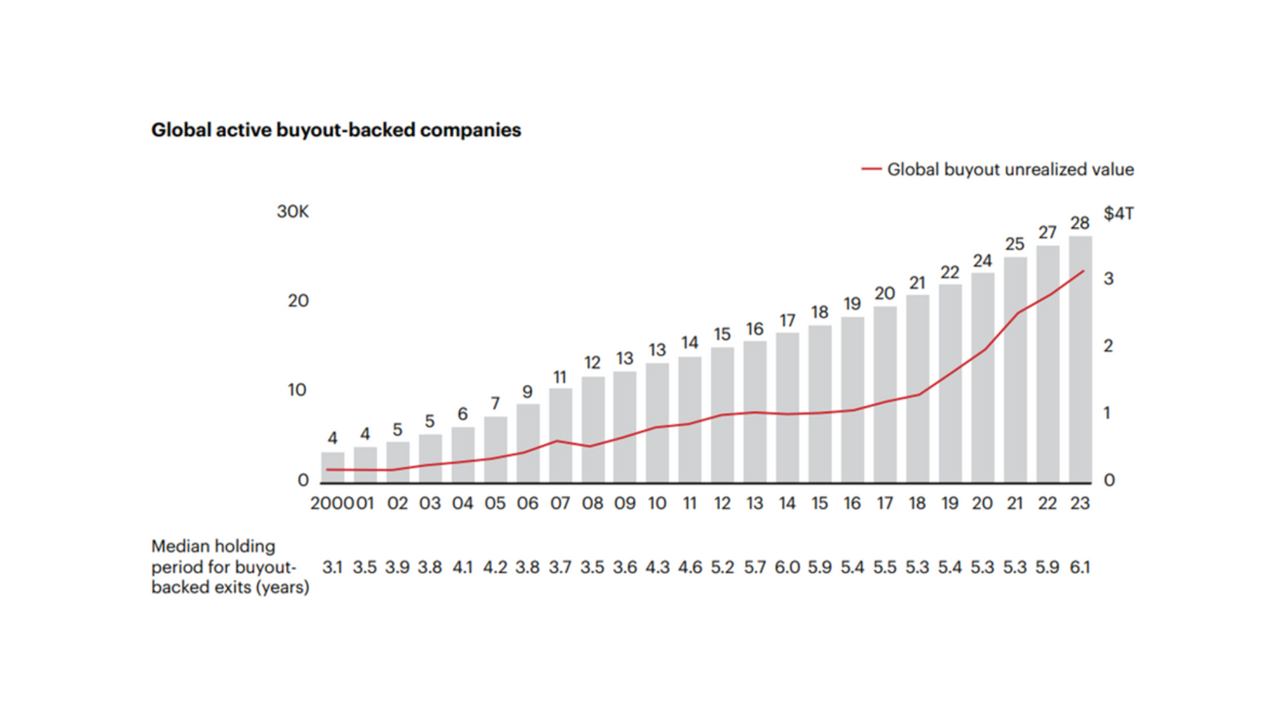

Traditionally a Private Equity fund will hold onto a portfolio company for about four years: a length of time which has historically proven sufficient to work their magic and achieve strong returns through tactics that include organic top-line growth, operational improvements, and capital structure efficiency gains. Then, they sell it on and divvy out distributions to their LPs. But they haven’t been doing much of this of-late.

So What Has Changed?

Put simply, the landscape has shifted, and it has proven harder to exit. The IPO route has all but dried up and soaring interest rates have tempered enthusiasm for acquisition amongst those larger private equity funds and corporates who would usually be the interested buyers for such assets. Data from Bain & Company’s Global Private Equity Report 2024 shows that the median holding period for buyout-backed exits has now reached a record 6.1 years (see chart). Unfathomable just a few short years ago.

The impact of these lengthening hold periods is well covered by Bain & Co’s report, but I want to focus on the decision that private equity funds need to make, that is whether to continue to pursue M&A at the portfolio company level. In other words, to deal or not to deal?

The Impact of Extended Hold Periods

This extension in hold periods requires a strategic reassessment.

Traditional private equity playbooks might suggest preparing for an exit during the later years of the hold, typically steering away from further acquisitions. But is this the best course of action? At Finquest, we’ve asserted for years that, until a portfolio company is exited, there is tremendous value in continuing to explore potential acquisitions. Right until the end of the hold period. The logic is twofold:

- When the private equity fund is successful in exiting, it will be able to demonstrate the potential for further inorganic growth, which may help achieve a higher exit value. Or,

- If the exit does not materialize, value creation efforts can continue uninterrupted.

The current market dynamics are proving that assertion to be truer than ever: the additional years added to traditional hold periods start to chip away at the value created in the early years, especially as many of those portfolio companies were acquired when multiples were at an all-time high. Moreover, a challenging macroeconomic environment and stubbornly high interest rates have stifled organic growth and directly impacted the internal rate of return (IRR).

Why Pursue M&A until Exit?: The case for “to deal”

In such a scenario, inaction will slowly but surely lead to a deterioration of hard-earned and created value. The decision for private equity funds (particularly for those portfolio companies where M&A is a strategic fit) should unequivocally be: “to deal”. Pursuing M&A right until the exit will not only preserve value but potentially also enhance it, preparing the asset for a more profitable and strategic exit.

Strategic Adaptations for Longer Hold Periods

Private Equity finds itself at a crossroads where the traditional norms of quick exits are being challenged by economic realities. The ability to adapt your strategy in response to longer hold periods will be a crucial factor in your success.

If you’d like to talk more about how your competitors are dealing in these extended hold periods, you can reach me on gerard.belicha@finquest.com

About the Author:

Gerard Belicha is CRO & Co-Founder of Finquest.

A seasoned banker and entrepreneur, Gerard has over 20 years of experience in deal origination, sales, emerging markets, corporate finance, and risk management. He is also an affiliate founding partner of True Global Ventures and a mentor at the University of Lausanne. He holds a master’s degree in finance from HEC Lausanne and is a certified master practitioner of neuro-linguistic programming. He lives in Hong Kong with his wife and two children.